library(readr)

library(tidyverse)

case7_1 <- read_csv("case7.1.csv") %>%

rename(存货周转率 = x1,

总资产周转率 = x2,

流动资产周转率 = x3,

营业利润率 = x4,

毛利率 = x5,

成本费用利润率 = x6,

总资产报酬率 = x7,

净资产收益率 = x8,

每股收益率 = x9,

扣除非经常性损益的每股收益 = x10,

每股未分配利润 = x11,

每股净资产 = x12

)7 FA习题讲评

教材P151 案例7.6

# step 1

library(psych)

KMO(case7_1[-1])Kaiser-Meyer-Olkin factor adequacy

Call: KMO(r = case7_1[-1])

Overall MSA = 0.79

MSA for each item =

存货周转率 总资产周转率

0.82 0.65

流动资产周转率 营业利润率

0.61 0.80

毛利率 成本费用利润率

0.89 0.77

总资产报酬率 净资产收益率

0.77 0.78

每股收益率 扣除非经常性损益的每股收益

0.79 0.79

每股未分配利润 每股净资产

0.89 0.88 library(EFAtools)

BARTLETT(case7_1[-1])

✔ The Bartlett's test of sphericity was significant at an alpha level of .05.

These data are probably suitable for factor analysis.

𝜒²(66) = 1010.1, p < .001# step 2

#计算特征值和特征向量

library(tidyverse)

case7_1.ev <- case7_1 %>%

select(-1) %>% cor() %>%

eigen()

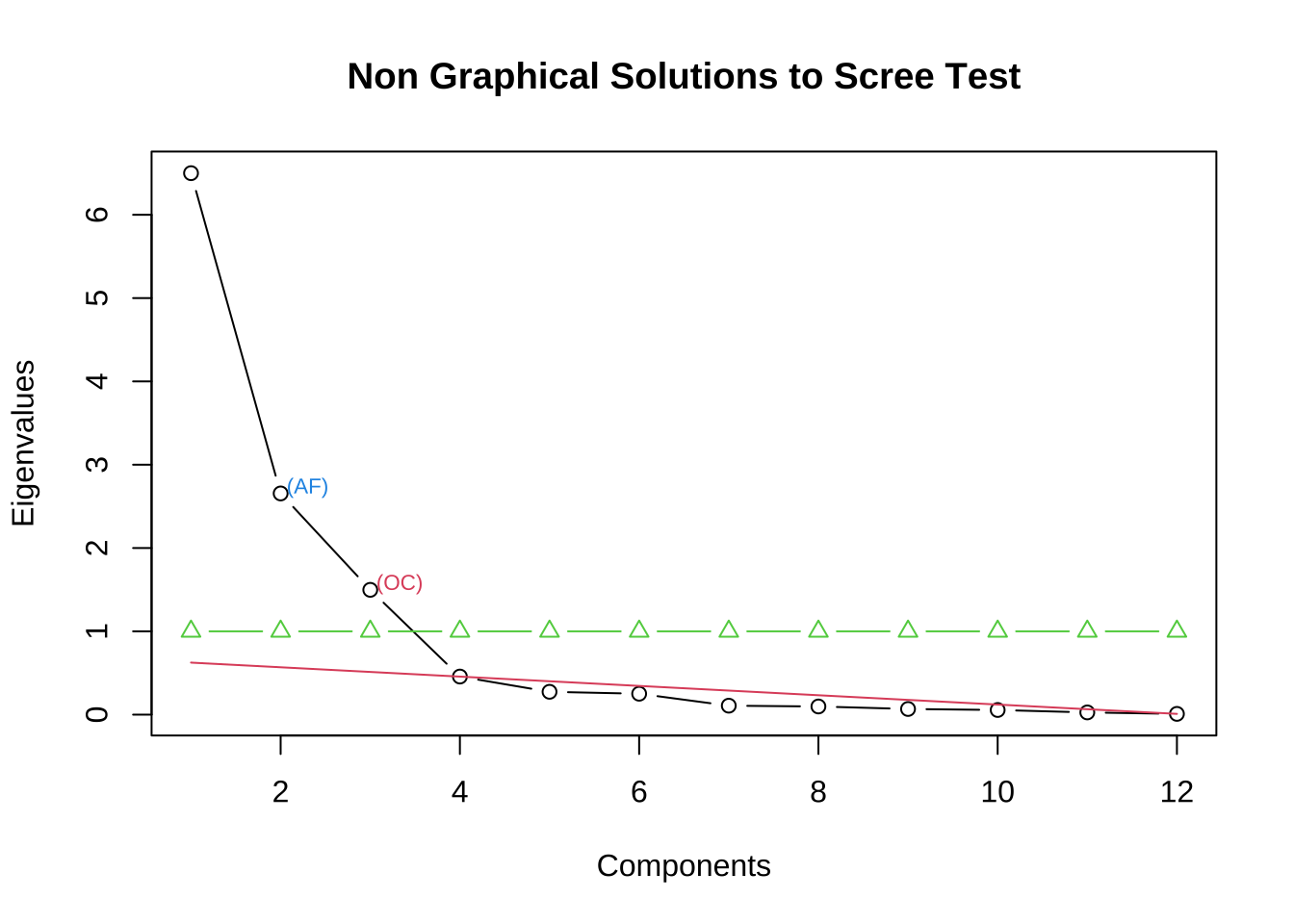

case7_1.eveigen() decomposition

$values

[1] 6.499533804 2.654940434 1.498015224 0.457112219 0.274204566 0.251019040

[7] 0.107527371 0.097961610 0.067989899 0.055824591 0.026693650 0.009177591

$vectors

[,1] [,2] [,3] [,4] [,5]

[1,] 0.09244934 -0.477942255 0.05813051 0.841178011 0.03145094

[2,] 0.14156255 -0.510840674 -0.24058789 -0.292348983 -0.01653565

[3,] 0.11396951 -0.524423948 -0.24305043 -0.326001981 -0.23004977

[4,] 0.31943729 0.092092805 -0.32649716 0.186801205 -0.46156889

[5,] 0.26320084 0.359901186 -0.20646040 0.001269517 -0.12764452

[6,] 0.33013418 0.251211794 -0.18956461 0.184085750 -0.15605637

[7,] 0.34205073 0.132406992 -0.28087340 -0.013460429 0.30932073

[8,] 0.34921919 -0.077629433 -0.27080622 -0.045567816 0.31120190

[9,] 0.35203886 -0.016220410 0.33198939 -0.047641358 0.22911864

[10,] 0.35587756 -0.005797506 0.29858780 -0.035372439 0.21626107

[11,] 0.33113545 -0.098353749 0.32947303 -0.119334215 0.17254721

[12,] 0.28095737 -0.030775036 0.48410100 -0.108955477 -0.60873581

[,6] [,7] [,8] [,9] [,10] [,11]

[1,] -0.1768332629 0.04573485 -0.03270303 -0.09875414 0.07971144 -0.01808396

[2,] -0.2808558579 -0.14250773 0.07575002 0.57019837 0.29654994 0.23670175

[3,] -0.0250653760 0.33986884 -0.12436745 -0.36834886 -0.39212881 -0.26817548

[4,] 0.4907354140 -0.29243188 -0.17916257 0.25284266 0.04959833 -0.33165214

[5,] -0.6623872468 -0.02297448 -0.49285071 -0.16465110 0.16926101 -0.05967790

[6,] 0.0001332728 0.48738638 0.18625489 0.24484958 -0.39198754 0.49024948

[7,] -0.0177809801 0.26740169 0.53232291 -0.12200012 0.37530228 -0.37541743

[8,] 0.1836614909 -0.48270097 0.02303125 -0.46759327 -0.07678284 0.43511797

[9,] -0.0676631801 -0.03966850 0.03201316 0.16744682 -0.18867682 -0.34464400

[10,] -0.1410113860 -0.24951050 -0.03736233 0.21446362 -0.43964946 -0.12369914

[11,] 0.3727798520 0.39358992 -0.48947667 -0.01017771 0.38644169 0.18250240

[12,] -0.1103111084 -0.12350439 0.37699725 -0.26605576 0.20542765 0.14203535

[,12]

[1,] 0.01452807

[2,] -0.03681929

[3,] 0.02732101

[4,] 0.01088018

[5,] -0.02772321

[6,] -0.08684279

[7,] 0.19712367

[8,] -0.13649776

[9,] -0.72196255

[10,] 0.63088779

[11,] 0.10907353

[12,] 0.02494923#绘制碎石图

library(nFactors)

case7_1.ev$values %>% nScree() %>%

plotnScree(legend = F)

#未旋转

fa.pc.none <- principal(case7_1[-1], nfactors = 3,

rotate = "none")

fa.pc.nonePrincipal Components Analysis

Call: principal(r = case7_1[-1], nfactors = 3, rotate = "none")

Standardized loadings (pattern matrix) based upon correlation matrix

PC1 PC2 PC3 h2 u2 com

存货周转率 0.24 0.78 -0.07 0.67 0.333 1.2

总资产周转率 0.36 0.83 0.29 0.91 0.090 1.6

流动资产周转率 0.29 0.85 0.30 0.90 0.097 1.5

营业利润率 0.81 -0.15 0.40 0.85 0.155 1.5

毛利率 0.67 -0.59 0.25 0.86 0.142 2.3

成本费用利润率 0.84 -0.41 0.23 0.93 0.070 1.6

总资产报酬率 0.87 -0.22 0.34 0.93 0.075 1.4

净资产收益率 0.89 0.13 0.33 0.92 0.081 1.3

每股收益率 0.90 0.03 -0.41 0.97 0.029 1.4

扣除非经常性损益的每股收益 0.91 0.01 -0.37 0.96 0.043 1.3

每股未分配利润 0.84 0.16 -0.40 0.90 0.099 1.5

每股净资产 0.72 0.05 -0.59 0.87 0.133 1.9

PC1 PC2 PC3

SS loadings 6.50 2.65 1.50

Proportion Var 0.54 0.22 0.12

Cumulative Var 0.54 0.76 0.89

Proportion Explained 0.61 0.25 0.14

Cumulative Proportion 0.61 0.86 1.00

Mean item complexity = 1.6

Test of the hypothesis that 3 components are sufficient.

The root mean square of the residuals (RMSR) is 0.03

with the empirical chi square 9.42 with prob < 1

Fit based upon off diagonal values = 1fa.pc.varimax <- principal(case7_1[-1], nfactors = 3,

rotate = "varimax")

fa.pc.varimaxPrincipal Components Analysis

Call: principal(r = case7_1[-1], nfactors = 3, rotate = "varimax")

Standardized loadings (pattern matrix) based upon correlation matrix

RC1 RC3 RC2 h2 u2 com

存货周转率 -0.15 0.26 0.76 0.67 0.333 1.3

总资产周转率 0.13 0.07 0.94 0.91 0.090 1.1

流动资产周转率 0.08 0.02 0.95 0.90 0.097 1.0

营业利润率 0.88 0.22 0.16 0.85 0.155 1.2

毛利率 0.85 0.21 -0.32 0.86 0.142 1.4

成本费用利润率 0.89 0.35 -0.12 0.93 0.070 1.3

总资产报酬率 0.91 0.30 0.10 0.93 0.075 1.2

净资产收益率 0.79 0.34 0.42 0.92 0.081 1.9

每股收益率 0.40 0.89 0.12 0.97 0.029 1.4

扣除非经常性损益的每股收益 0.43 0.87 0.12 0.96 0.043 1.5

每股未分配利润 0.31 0.87 0.23 0.90 0.099 1.4

每股净资产 0.15 0.92 0.04 0.87 0.133 1.1

RC1 RC3 RC2

SS loadings 4.25 3.64 2.77

Proportion Var 0.35 0.30 0.23

Cumulative Var 0.35 0.66 0.89

Proportion Explained 0.40 0.34 0.26

Cumulative Proportion 0.40 0.74 1.00

Mean item complexity = 1.3

Test of the hypothesis that 3 components are sufficient.

The root mean square of the residuals (RMSR) is 0.03

with the empirical chi square 9.42 with prob < 1

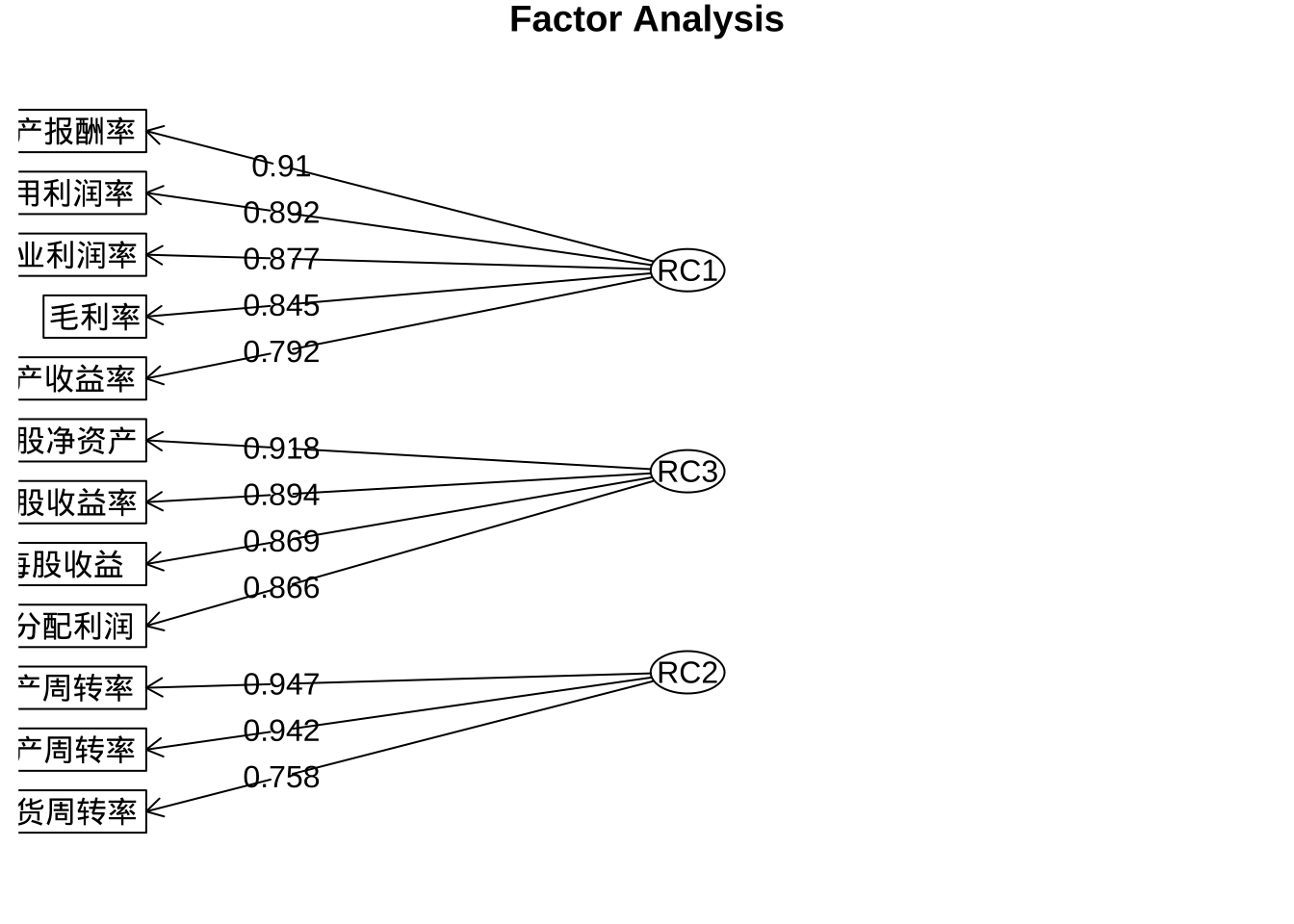

Fit based upon off diagonal values = 1#按因子载荷系数降序排列

print(fa.pc.varimax$loadings, digits = 3, cutoff = 0.5,sort = T)

Loadings:

RC1 RC3 RC2

营业利润率 0.877

毛利率 0.845

成本费用利润率 0.892

总资产报酬率 0.910

净资产收益率 0.792

每股收益率 0.894

扣除非经常性损益的每股收益 0.869

每股未分配利润 0.866

每股净资产 0.918

存货周转率 0.758

总资产周转率 0.942

流动资产周转率 0.947

RC1 RC3 RC2

SS loadings 4.246 3.638 2.769

Proportion Var 0.354 0.303 0.231

Cumulative Var 0.354 0.657 0.888#绘制因子载荷系数图

fa.diagram(fa.pc.varimax$loadings, digits = 3)

plot(fa.pc.varimax$loadings, type = "n")

library(psych)

fa.ml.varimax <- fa(case7_1[-1],

nfactors = 3,

fm = "ml",

rotate = "varimax")

fa.ml.varimaxFactor Analysis using method = ml

Call: fa(r = case7_1[-1], nfactors = 3, rotate = "varimax", fm = "ml")

Standardized loadings (pattern matrix) based upon correlation matrix

ML3 ML1 ML2 h2 u2 com

存货周转率 -0.11 0.23 0.63 0.46 0.5381 1.3

总资产周转率 0.11 0.09 0.95 0.92 0.0785 1.0

流动资产周转率 0.06 0.02 0.96 0.92 0.0803 1.0

营业利润率 0.86 0.20 0.15 0.80 0.1957 1.2

毛利率 0.81 0.22 -0.28 0.79 0.2126 1.4

成本费用利润率 0.89 0.34 -0.12 0.92 0.0768 1.3

总资产报酬率 0.90 0.32 0.10 0.92 0.0769 1.3

净资产收益率 0.77 0.36 0.41 0.90 0.1029 2.0

每股收益率 0.39 0.91 0.12 1.00 0.0048 1.4

扣除非经常性损益的每股收益 0.42 0.88 0.12 0.98 0.0246 1.5

每股未分配利润 0.31 0.85 0.23 0.87 0.1311 1.4

每股净资产 0.16 0.85 0.07 0.76 0.2448 1.1

ML3 ML1 ML2

SS loadings 4.09 3.55 2.59

Proportion Var 0.34 0.30 0.22

Cumulative Var 0.34 0.64 0.85

Proportion Explained 0.40 0.35 0.25

Cumulative Proportion 0.40 0.75 1.00

Mean item complexity = 1.3

Test of the hypothesis that 3 factors are sufficient.

df null model = 66 with the objective function = 18.65 with Chi Square = 1010.1

df of the model are 33 and the objective function was 1.75

The root mean square of the residuals (RMSR) is 0.02

The df corrected root mean square of the residuals is 0.03

The harmonic n.obs is 60 with the empirical chi square 4.1 with prob < 1

The total n.obs was 60 with Likelihood Chi Square = 91.42 with prob < 2.2e-07

Tucker Lewis Index of factoring reliability = 0.871

RMSEA index = 0.171 and the 90 % confidence intervals are 0.132 0.216

BIC = -43.7

Fit based upon off diagonal values = 1

Measures of factor score adequacy

ML3 ML1 ML2

Correlation of (regression) scores with factors 0.98 0.99 0.98

Multiple R square of scores with factors 0.96 0.99 0.96

Minimum correlation of possible factor scores 0.92 0.97 0.92#按因子载荷系数降序排列

print(fa.ml.varimax$loadings, digits = 3, cutoff = 0.5,sort = T)

Loadings:

ML3 ML1 ML2

营业利润率 0.862

毛利率 0.812

成本费用利润率 0.892

总资产报酬率 0.901

净资产收益率 0.771

每股收益率 0.911

扣除非经常性损益的每股收益 0.884

每股未分配利润 0.847

每股净资产 0.851

存货周转率 0.628

总资产周转率 0.949

流动资产周转率 0.957

ML3 ML1 ML2

SS loadings 4.090 3.549 2.594

Proportion Var 0.341 0.296 0.216

Cumulative Var 0.341 0.637 0.853#函数psych::fa,varimax旋转

library(psych)

fa.pa.varimax <- fa(case7_1[-1],

nfactors = 3,

fm = "pa",

rotate = "varimax")

print(fa.pa.varimax$loadings, digits = 3, cutoff = 0.5,sort = T)

Loadings:

PA1 PA3 PA2

营业利润率 0.839

毛利率 0.816

成本费用利润率 0.896

总资产报酬率 0.906

净资产收益率 0.780

每股收益率 0.913

扣除非经常性损益的每股收益 0.878

每股未分配利润 0.848

每股净资产 0.851

存货周转率 0.640

总资产周转率 0.943

流动资产周转率 0.944

PA1 PA3 PA2

SS loadings 4.094 3.533 2.594

Proportion Var 0.341 0.294 0.216

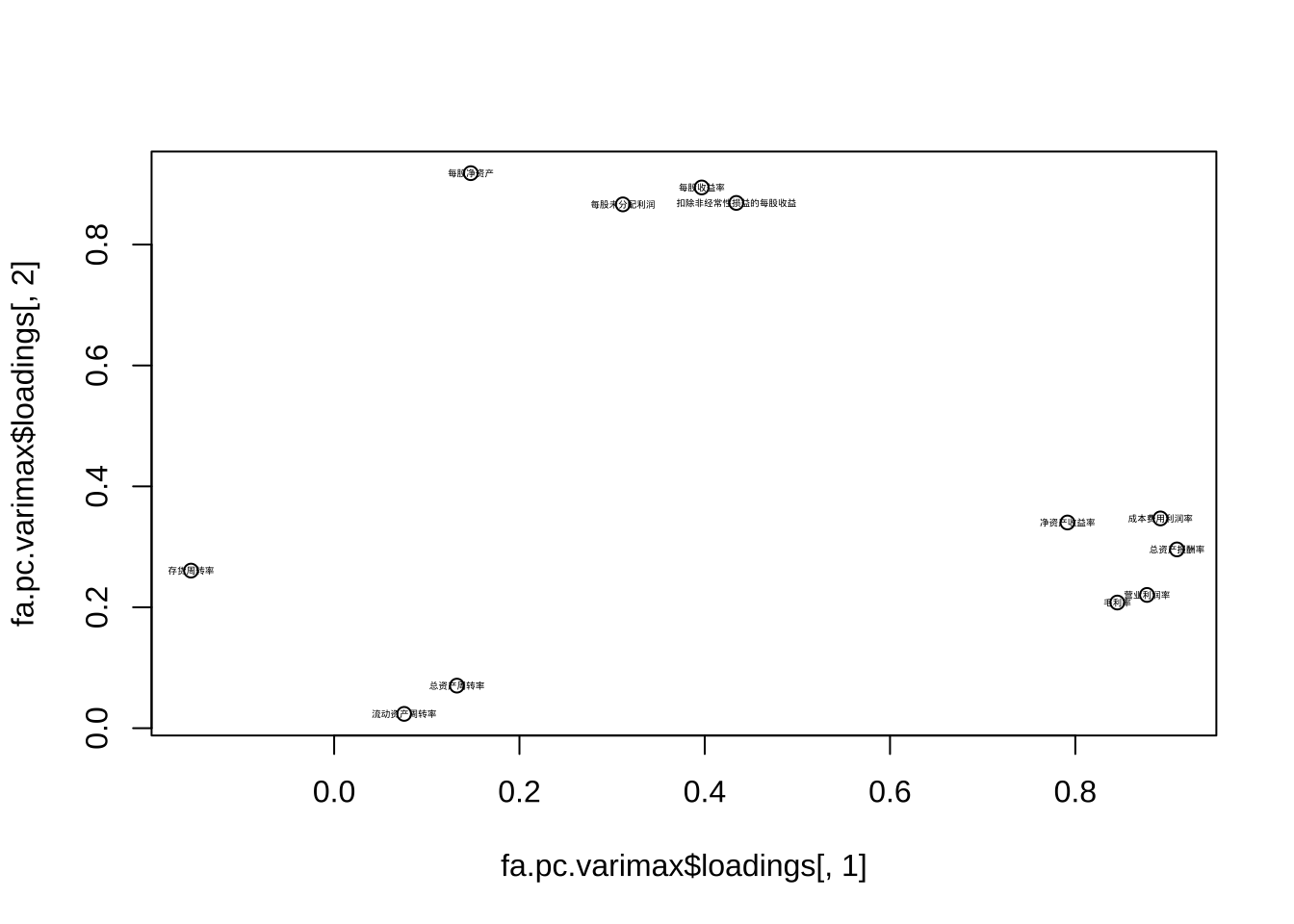

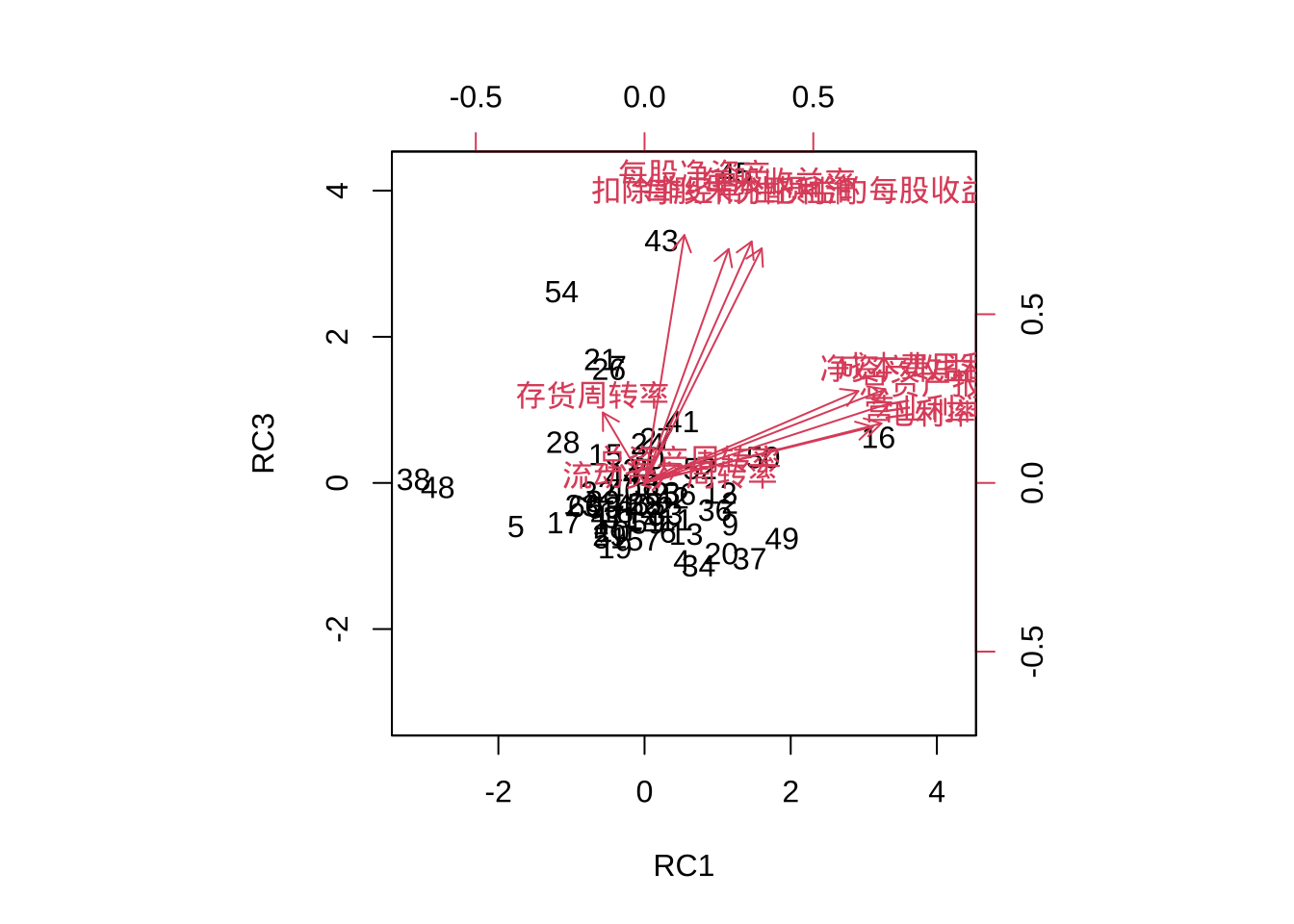

Cumulative Var 0.341 0.636 0.852plot(fa.pc.varimax$loadings[,1],

fa.pc.varimax$loadings[,2])

text(fa.pc.varimax$loadings[,1],

fa.pc.varimax$loadings[,2],

rownames(fa.pc.varimax$loadings),

cex = 0.3)

biplot(fa.pc.varimax$scores[,1:2],

fa.pc.varimax$loadings[,1:2])

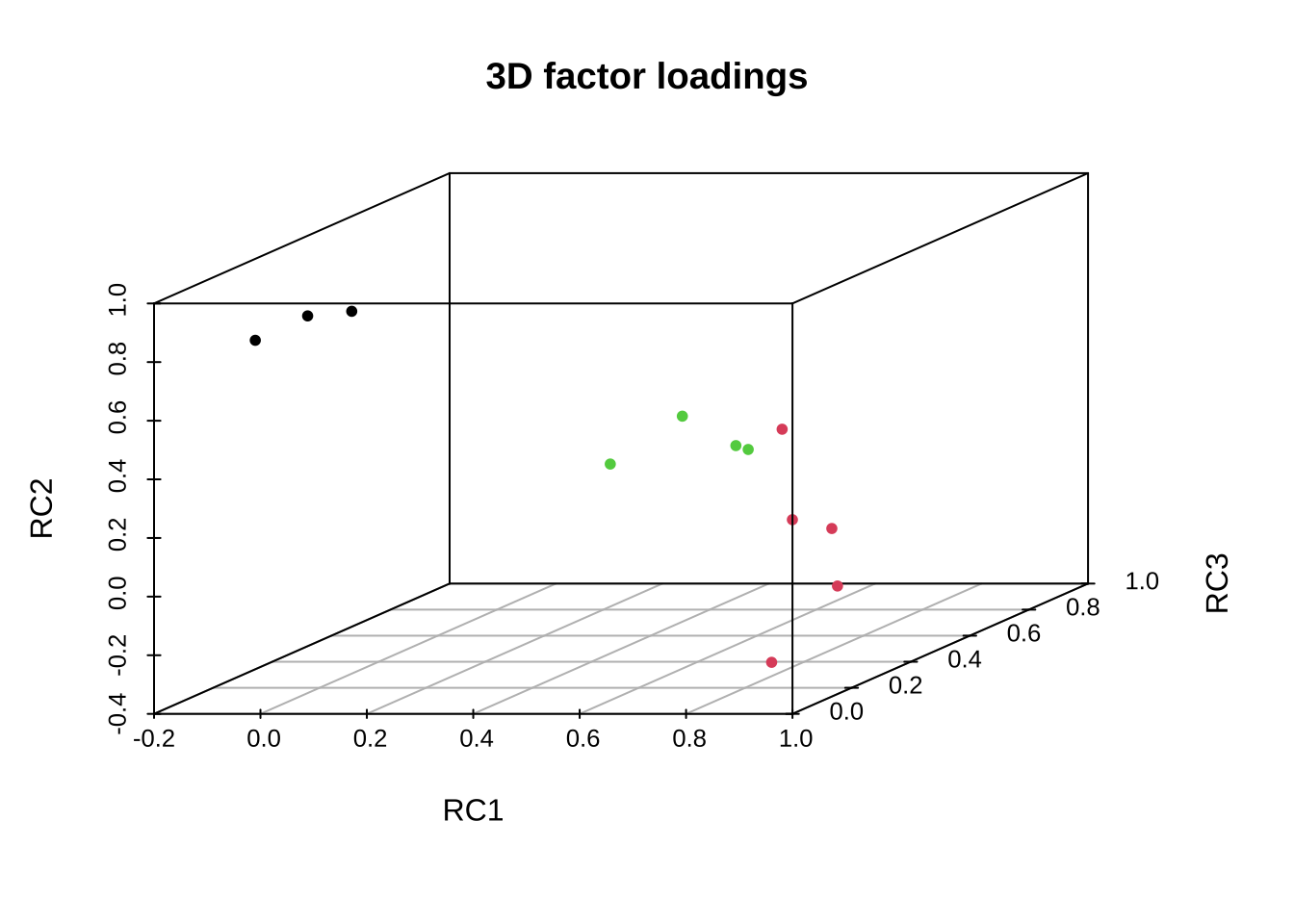

library(scatterplot3d)

scatterplot3d(fa.pc.varimax$loadings,

main="3D factor loadings",

color=c(rep(1,3), rep(2,5), rep(3,4)),

pch=20)

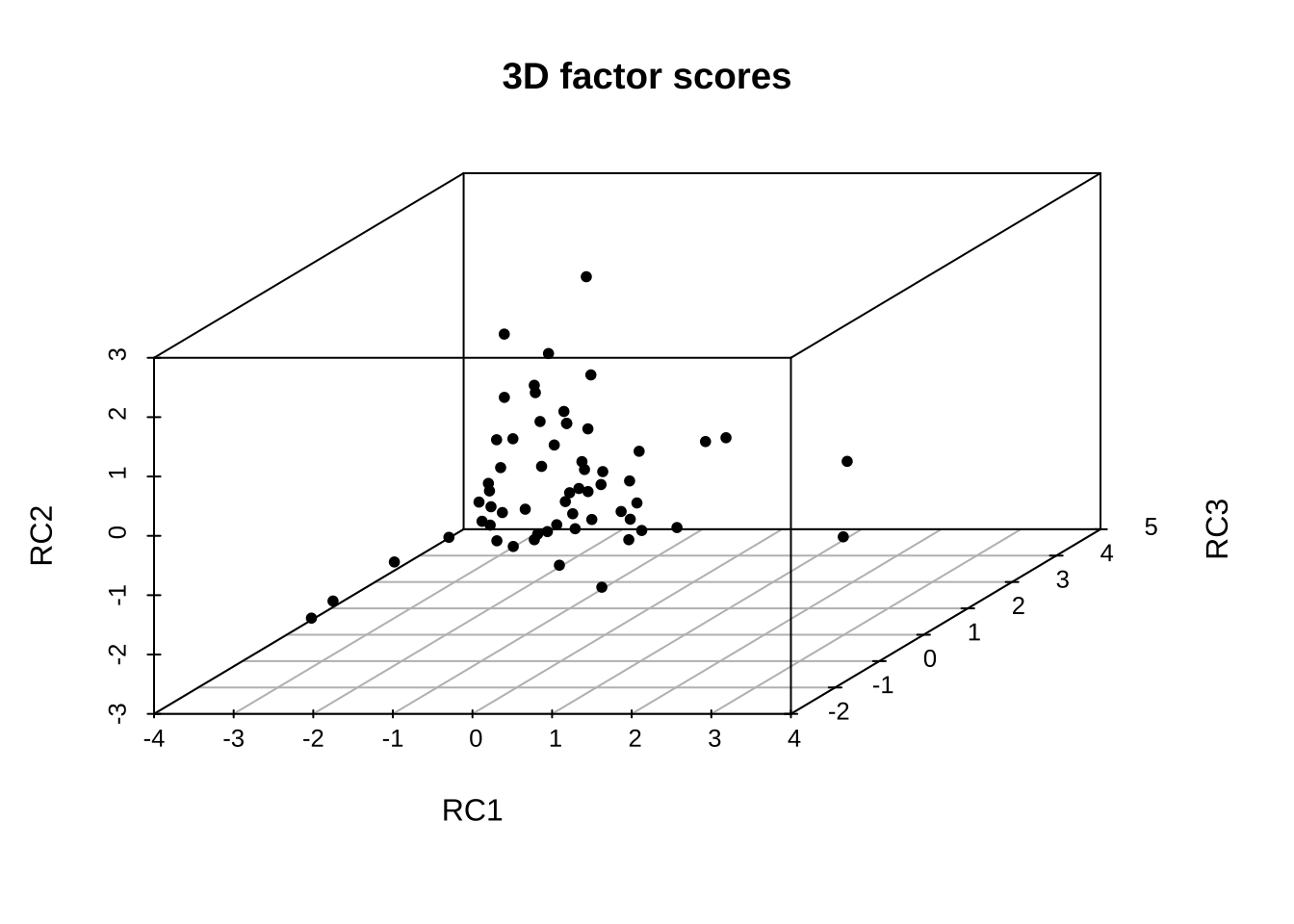

scatterplot3d(fa.pc.varimax$scores,

main="3D factor scores",

pch=20)

fa.pc.varimax$Callprincipal(r = case7_1[-1], nfactors = 3, rotate = "varimax")fa.pc.varimax <- principal(case7_1[-1], nfactors = 3,

rotate = "varimax",

method = "wls")

fa.pc.varimax$scores %>%

data.frame() %>%

cbind(case7_1$证券名称,.) %>%

select(1:2) %>%

arrange(desc(RC1))%>%

head() case7_1$证券名称 RC1

1 新坐标 3.200275

2 浙江仙通 1.880036

3 岱美股份 1.622674

4 继峰股份 1.438485

5 兆丰股份 1.240185

6 中原内配 1.169983fa.pc.varimax$scores %>%

data.frame() %>%

cbind(case7_1$证券名称,.) %>%

select(1,3) %>%

arrange(desc(RC3))%>%

head() case7_1$证券名称 RC3

1 兆丰股份 4.239737

2 苏威孚B 3.316791

3 华域汽车 2.615909

4 德尔股份 1.690839

5 越博动力 1.594501

6 宁波华翔 1.556167fa.pc.varimax$scores %>%

data.frame() %>%

cbind(case7_1$证券名称,.) %>%

select(1,4) %>%

arrange(desc(RC2)) %>%

head() case7_1$证券名称 RC2

1 东风科技 2.567504

2 华域汽车 2.314485

3 亚普股份 2.308875

4 众泰汽车 1.693966

5 交运股份 1.556585

6 凌云股份 1.353060教材P160 习题7.7

library(readxl)

library(tidyverse)

ex7_7 <- read_excel("ex6.6.xls") %>%

rename(工业废水排放量 = x1,

工业化学需氧量 = x2,

工业氨氮排放量 = x3,

城镇生活污水排放量 = x4,

生活化学需氧量排放量 = x5,

生活氨氮排放量 = x6

)

rownames(ex7_7) <- ex7_7$城市 fa.pc.varimax <- principal(ex7_7[-1], nfactors = 2,

rotate = "varimax")

fa.pc.varimaxPrincipal Components Analysis

Call: principal(r = ex7_7[-1], nfactors = 2, rotate = "varimax")

Standardized loadings (pattern matrix) based upon correlation matrix

RC1 RC2 h2 u2 com

工业废水排放量 0.77 0.38 0.74 0.257 1.5

工业化学需氧量 0.53 0.81 0.93 0.068 1.7

工业氨氮排放量 0.10 0.96 0.93 0.069 1.0

城镇生活污水排放量 0.94 0.01 0.89 0.114 1.0

生活化学需氧量排放量 0.85 0.30 0.81 0.185 1.2

生活氨氮排放量 0.88 0.35 0.91 0.092 1.3

RC1 RC2

SS loadings 3.28 1.93

Proportion Var 0.55 0.32

Cumulative Var 0.55 0.87

Proportion Explained 0.63 0.37

Cumulative Proportion 0.63 1.00

Mean item complexity = 1.3

Test of the hypothesis that 2 components are sufficient.

The root mean square of the residuals (RMSR) is 0.06

with the empirical chi square 1.82 with prob < 0.77

Fit based upon off diagonal values = 0.99print(fa.pc.varimax$loadings, digits = 3, cutoff = 0.5,sort = T)

Loadings:

RC1 RC2

工业废水排放量 0.774

城镇生活污水排放量 0.941

生活化学需氧量排放量 0.851

生活氨氮排放量 0.884

工业化学需氧量 0.531 0.806

工业氨氮排放量 0.960

RC1 RC2

SS loadings 3.283 1.931

Proportion Var 0.547 0.322

Cumulative Var 0.547 0.869fa.pc.promax <- principal(ex7_7[-1], nfactors = 2,

rotate = "promax")

fa.pc.promaxPrincipal Components Analysis

Call: principal(r = ex7_7[-1], nfactors = 2, rotate = "promax")

Standardized loadings (pattern matrix) based upon correlation matrix

RC1 RC2 h2 u2 com

工业废水排放量 0.75 0.18 0.74 0.257 1.1

工业化学需氧量 0.33 0.75 0.93 0.068 1.4

工业氨氮排放量 -0.22 1.06 0.93 0.069 1.1

城镇生活污水排放量 1.07 -0.29 0.89 0.114 1.2

生活化学需氧量排放量 0.87 0.06 0.81 0.185 1.0

生活氨氮排放量 0.89 0.11 0.91 0.092 1.0

RC1 RC2

SS loadings 3.40 1.82

Proportion Var 0.57 0.30

Cumulative Var 0.57 0.87

Proportion Explained 0.65 0.35

Cumulative Proportion 0.65 1.00

With component correlations of

RC1 RC2

RC1 1.00 0.54

RC2 0.54 1.00

Mean item complexity = 1.1

Test of the hypothesis that 2 components are sufficient.

The root mean square of the residuals (RMSR) is 0.06

with the empirical chi square 1.82 with prob < 0.77

Fit based upon off diagonal values = 0.99print(fa.pc.promax$loadings, digits = 3, cutoff = 0.5,sort = T)

Loadings:

RC1 RC2

工业废水排放量 0.753

城镇生活污水排放量 1.068

生活化学需氧量排放量 0.867

生活氨氮排放量 0.887

工业化学需氧量 0.745

工业氨氮排放量 1.064

RC1 RC2

SS loadings 3.401 1.823

Proportion Var 0.567 0.304

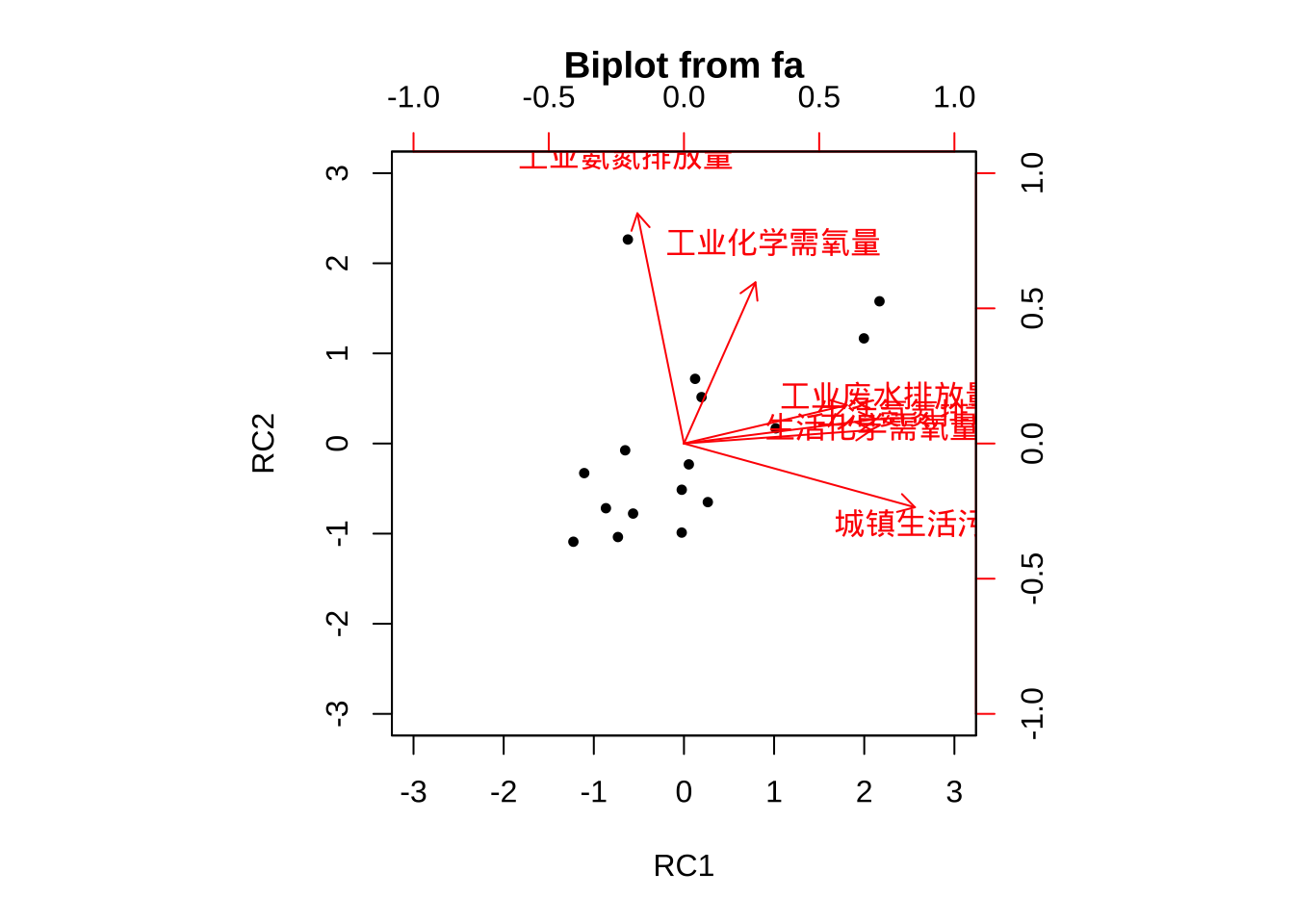

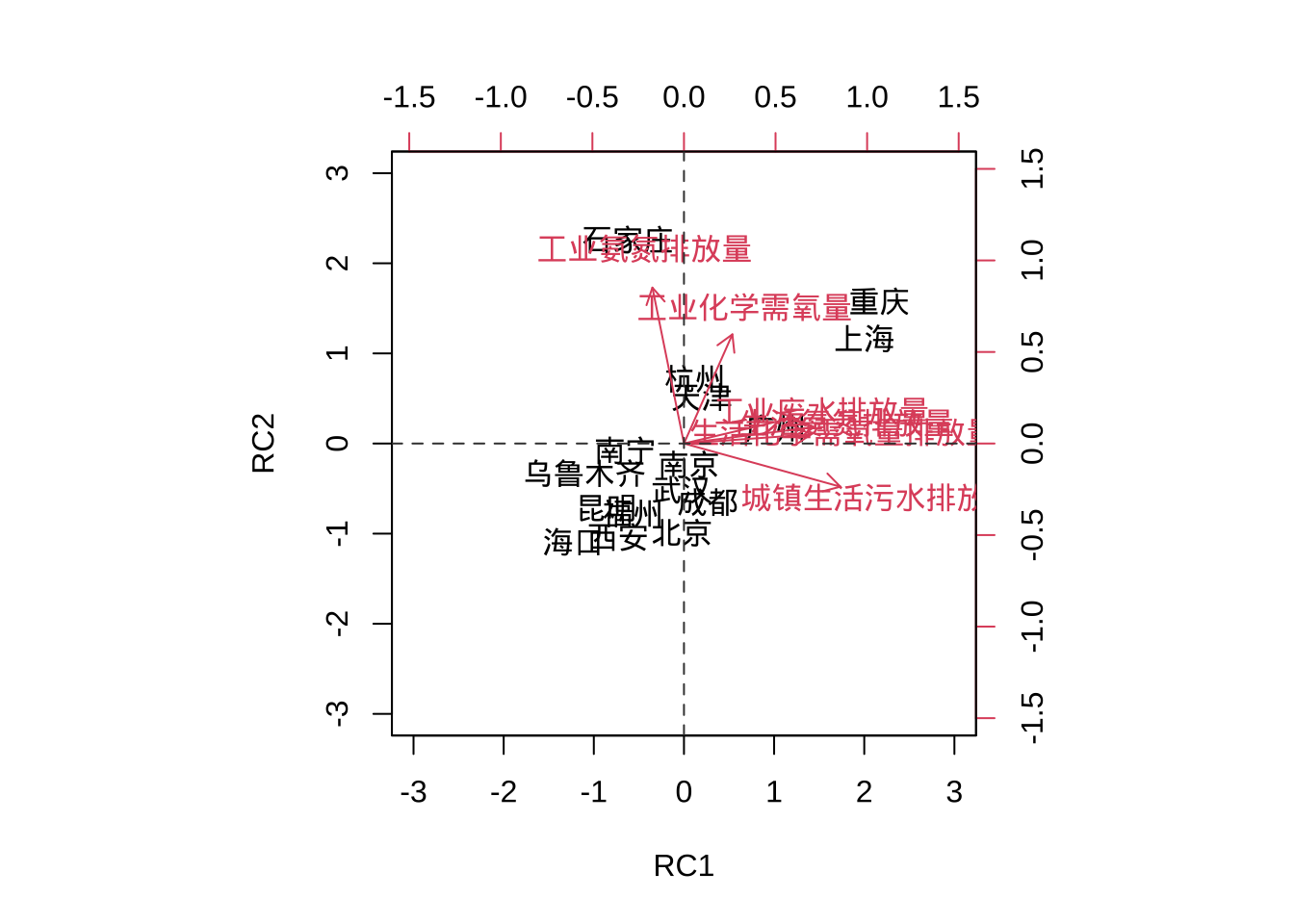

Cumulative Var 0.567 0.871biplot(fa.pc.promax)

biplot(fa.pc.promax$scores[,1:2],

fa.pc.promax$loadings[,1:2],

xlim = c(-3,3),

ylim = c(-3,3),

xlabs = ex7_7$城市)

abline(v = 0, h = 0, lty = 2, col = "grey25")

fa.pc.promax$scores %>%

round(3) %>%

cbind(ex7_7$城市,.) %>%

data.frame() %>%

arrange(desc(RC1)) %>%

head() V1 RC1 RC2

1 重庆 2.169 1.578

2 上海 1.996 1.167

3 广州 1.018 0.168

4 成都 0.265 -0.65

5 天津 0.195 0.515

6 杭州 0.124 0.718fa.pc.promax$scores %>%

round(3) %>%

cbind(ex7_7$城市,.) %>%

data.frame() %>%

arrange(desc(RC2)) %>%

head() V1 RC1 RC2

1 石家庄 -0.622 2.264

2 重庆 2.169 1.578

3 上海 1.996 1.167

4 杭州 0.124 0.718

5 天津 0.195 0.515

6 广州 1.018 0.168